Silver Price Explosion $29-$80 in a Single Year Threatens Global Manufacturing Boom

![]()

In a rare moment of concern from one of the world’s most influential tech moguls, Elon Musk has sounded the alarm on skyrocketing silver prices, declaring simply: “This is not good. Silver is needed in many industrial processes.”

As silver shattered records in late December 2025, hitting highs of around $79–$80 per ounce—up from just $29 at the start of the year—Musk’s warning highlights a brewing crisis for industries reliant on this versatile metal.

The Surge: From $29 to $80 in a Single Year

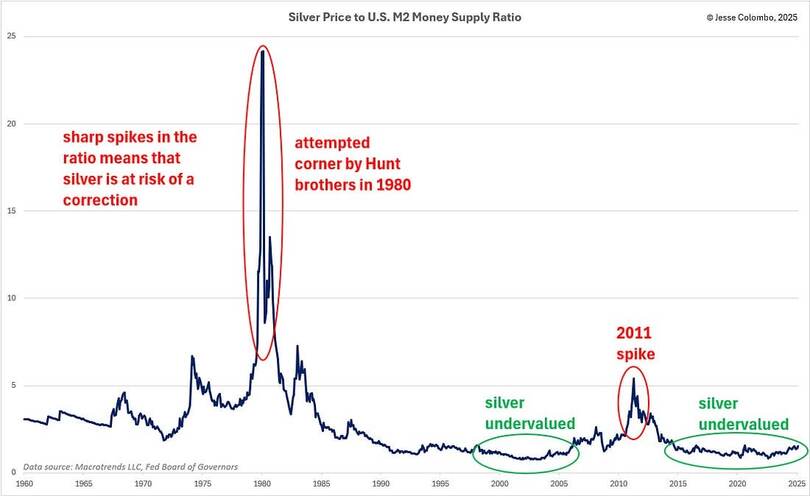

Silver’s extraordinary rally in 2025 has been nothing short of historic. Starting the year at approximately $29 per ounce, the metal surged to a peak of $79 on December 26–27 before briefly touching $80, marking a staggering increase of over 170%. This performance outpaces even gold’s impressive 70%+ gain to over $4,500 per ounce, putting both precious metals on track for their best annual returns since 1979.

The dramatic December spike—from $56 at the month’s start to record highs—was fueled by a perfect storm of factors:

- Anticipated US Federal Reserve rate cuts in 2026, boosting demand for precious metals as inflation hedges.

- Geopolitical tensions and safe-haven buying amid global uncertainties.

- Robust industrial demand, particularly from electrification, solar panels, electric vehicles (EVs), data centers, and electronics.

- Impending Chinese export restrictions, set to take effect January 1, 2026, requiring government licenses for silver shipments and sparking acute supply fears.

China’s move, in particular, has amplified concerns, as the country plays a significant role in global mineral supply chains. Combined with depleting above-ground inventories and structural supply deficits—where demand has consistently outstripped mined supply for years—the market is facing what analysts call a “generational bubble.”

Why Silver Matters: Beyond Jewelry to Industrial Powerhouse

Unlike gold, which is primarily a monetary asset, silver’s dual nature—as both a precious metal and a critical industrial input—makes its price surge particularly disruptive.

Over half of silver demand comes from industry, including:

- Solar energy: Silver paste is essential for photovoltaic cells.

- Electric vehicles: Used in electrical contacts, batteries, and wiring.

- Electronics and data centers: For conductors and components in AI hardware and semiconductors.

- Other sectors: Medical devices, automotive catalytic converters (related platinum/palladium surges noted), and more.

Rising demand from the green energy transition and tech boom has rapidly depleted inventories, leaving manufacturers vulnerable to shortages and cost spikes.

Musk’s Concern: A Wake-Up Call for Tesla and Beyond

Elon Musk’s post on X, responding to reports of China’s export curbs, underscores the real-world implications. As CEO of Tesla—a company heavily invested in EVs and renewable energy—Musk is acutely aware of how silver shortages could drive up production costs, delay manufacturing, or force costly substitutions.

Experts warn that without alternatives (silver’s conductivity is hard to replace affordably), industries could face:

- Higher costs passed on to consumers.

- Supply chain disruptions.

- Slowed growth in clean energy and tech sectors.

While some see opportunities for innovation or new mining, the short-term outlook remains challenging. A potential US investigation into critical mineral imports could add tariffs, further tightening supply.

As 2025 draws to a close, Musk’s blunt assessment serves as a reminder: the glittering silver rally may shine for investors, but for manufacturers powering the future, it signals stormy skies ahead.

Leave a Reply

Want to join the discussion?Feel free to contribute!